How to start(up) a conversation: Business and finance

Did you ever wonder what the terms EOD, Mom and AUM mean? Job seekers or vendors who want to work at or with startups must understand the terms in this industry so as to be able to adapt quickly.

Startup

Emerging startups which still need funding to cover operating costs. A startup that can survive for ten years or more and has hundreds or thousands of employees levels up to a fully-fledged business or a mature company.

Angel investor

Individual investor. Many close friends, spouses, or family members become angel investors for a startup.

Venture capital

An investment company focusing on companies at an early stage. Venture capital provides investment in the form of stock or convertible debt. Venture capital is a money machine for startups.

Bootstrapping

A business development strategy where the owner chooses to fund the company’s operations with their own money and rely on internal power.

Seed funding

Capital invested in products at the development, marketing and market research phases. Venture capital starts its investment at this stage.

Series A, B, C funding

The investment stage after bootstrapping and seed funding. Cited from Investopedia, here are the details of Series A, B, and C funding:

Series A funding is a funding stage where investors search for startups that have brilliant ideas with excellent business strategy and are believed to be able to become a successful company and earn a lot of money. Series A is for companies that are still focusing on development, such as market research, product development and facilities development.

Series B funding is held by companies that have passed the development stage and are focusing on improving market share and surplus growth. In this stage, the company also aggressively hires talented employees.

Series C funding is sought by companies that pursue growth and business expansion as fast and as successful as possible. Series C is often the last round that a company raises, although some do go on to raise Series D and even Series E round — or beyond. Companies that make it to a Series E usually plan to enter the stock market, so they need back-up funds, or because they haven’t yet achieved their goals in the Series C or D funding rounds.

Exit strategy

Emergency plans executed by investors, venture capital or owners to sell intangible business assets, from stock to cash.

This strategy can be used to pull out of investments before they collapse or to close down unprofitable businesses. In these cases, the purpose of exit strategy is to curb losses.

Incubator

A programme aimed at fostering new startups. Incubator programme provides various resources, from work space and training and mentoring programme to funding.

Unicorn

A company with a valuation of more than $1 billion.

GMV (Gross Merchandise Value) or turnover

The total amount of sales a company make on online platform over a specified period of time. GMV can be used to measure business growth and as a benchmark of how many active users are trading on the platform.

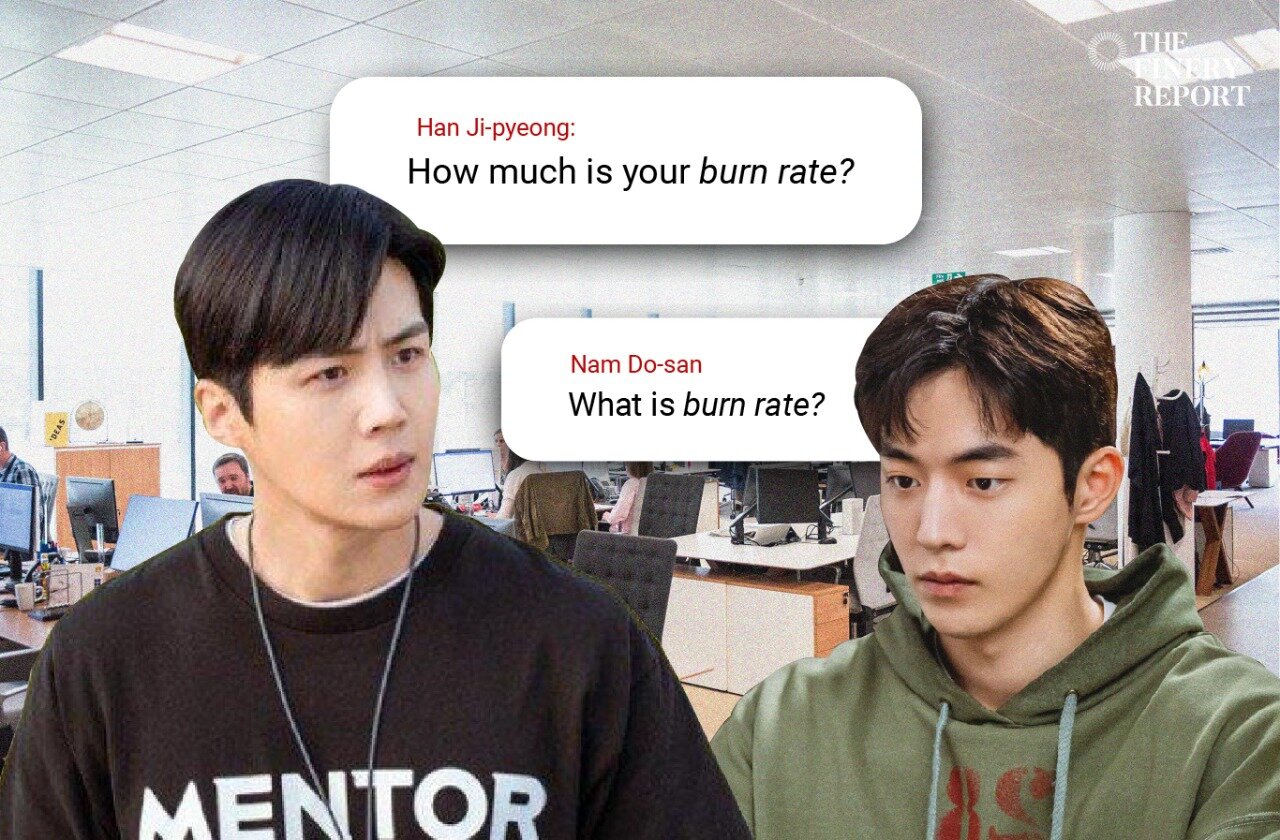

Burn Rate

Negative cash flow – the rate at which a startup is spending its capital. Startups usually burn their money for business development through promotions and to support their operations.

YOY (Year-over-Year)

A method of evaluating two or more measured events to compare the results at one period with those of a comparable period on an annualised basis. For example, financial analysts and investors can assess the health of a company's growth by comparing the first quarter growth of turnover on a YOY basis.

MOM (Month-over-Month, Manager-of-Managers, Minutes of the Meeting)

The three terms use the same acronym, but have completely different meanings.

Month-over-Month shows the change in the value of a specific metric as a percentage of the previous month's value.

Manager-of-Managers is a type of oversight investment strategy whereby a manager chooses managers for an investment program and regularly monitors their performance.

Minutes of the Meeting is a factual record of the meeting for its members while also acting as a source of information for people who were unable to attend.

Business-to-Customer (B2C)

The process of selling products and services directly between a business and consumers who are the end-users of its products or services. Most companies that sell directly to consumers can be referred to as B2C companies. Sayurbox, Halodoc, Gojek and Traveloka are B2C companies.

Business-to-Business (B2B)

A form of transaction between businesses. General Electric, WeWork, Boeing and Airbus, for example, provide services to companies that need the products they provide.

Customer-to-Customer (C2C)

Business model where consumers can trade with each other, usually online. Examples of companies that have a C2C business model are Tokopedia, Shopee, Bukalapak, and other e-commerce platforms.

Assets under Management (AUM)

The total market value of investments that an individual or entity manages on behalf of their client. In calculating AUM, some financial institutions include bank deposits, mutual funds and cash in their calculations.